ISO 20022 — Road to (data) riches

ISO 20022 — Road to (data) riches

ISO 20022 — Road to (data) riches

March 15, 2024

Current context

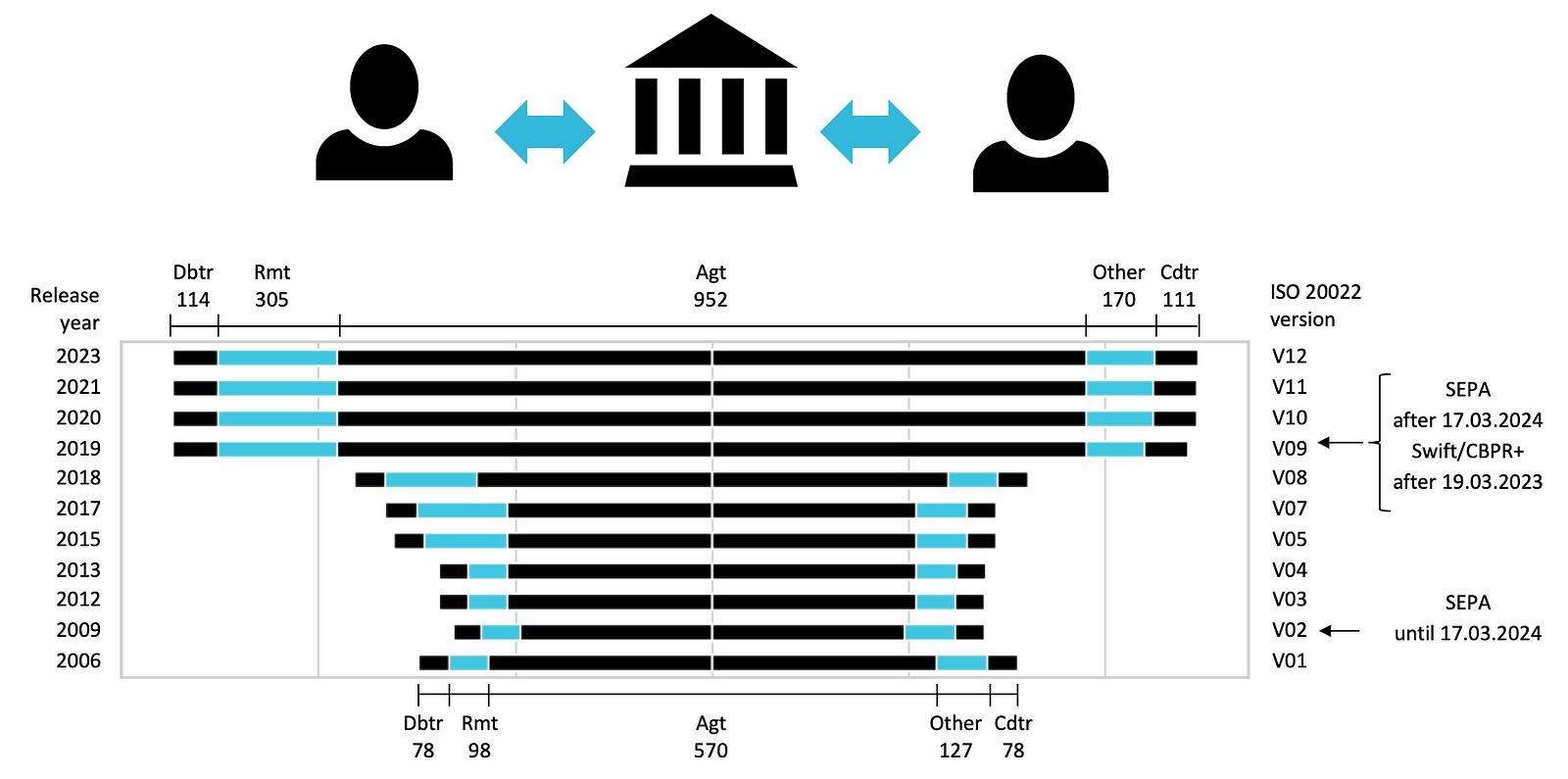

In March 2024, the entire SEPA (Single European Payment Area) is undergoing a significant upgrade, migrating from ISO 20022 version V02 to version V09. This updated standard is in line with the one getting adopted by Swift for cross-border payments, whose migration to ISO 20022 started in 2023, using V09 too.

The new version introduces a plethora of new attributes [5], which have the potential to significantly enhance the implementation of ISO 20022, delivering increased efficiencies and insights across Operations, Compliance, Cash Management, and Front Office functions.

Quantifying data richness

While the ISO 20022 standard is widely appreciated for its capacity to transmit rich and structured data, there’s little published about how to quantify this richness. By obtaining these metadata metrics, data strategists and architects can make more informed decisions when selecting the appropriate data (analytics) platforms, with databases at their core. This includes assessing their compatibility with varying market rules and related data requirements, while being ready to accommodate even richer data in the future.

Let’s initiate a metadata analysis to address this aspect.

Method

Metadata

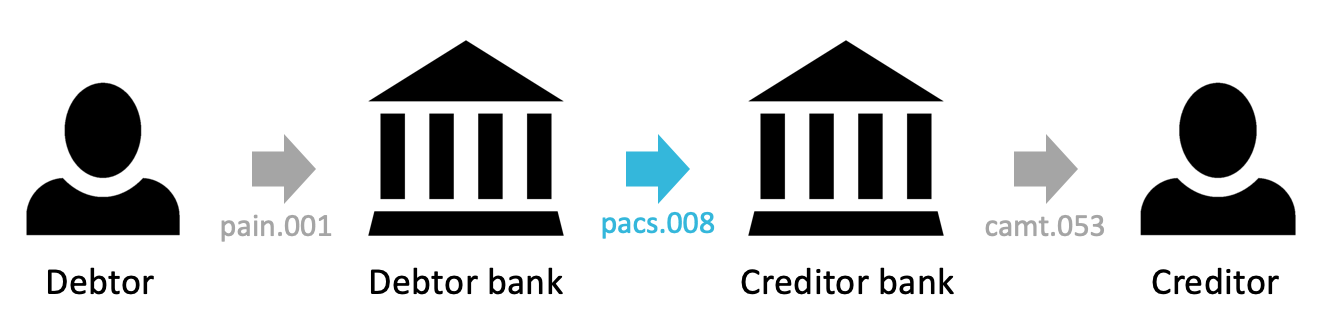

For this exercise, we will focus on the symptomatic pacs.008 message, specifically the “Financial Institution To Financial Institution Customer Credit Transfer,” which is central to many payment schemes worldwide.

We gather all published versions of pacs.008 from the ISO 20022 archive [2], convert the XSDs into synthetic XMLs, and then transform them into a data model for analytics using our Swiftflow-core API [3]. This process results in a fully structured data model that can be analyzed using Excel, SQL, or any structured data analytics package.

Metrics

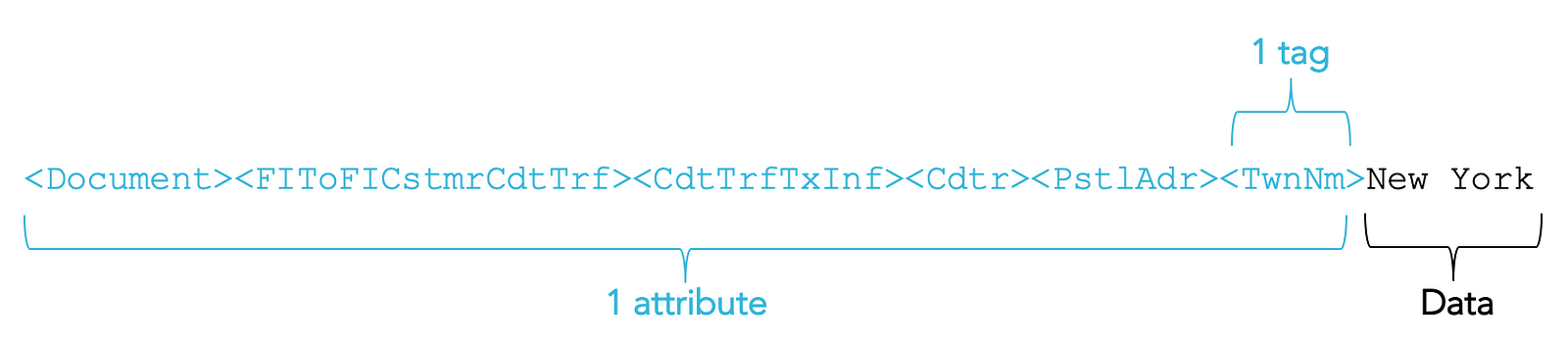

An XML document consists of tags that enclose a data element and provide a description of that element, carrying semantic meaning, as seen in the case of ISO 20022 shown hereafter where TwnNm is used for Town Name.

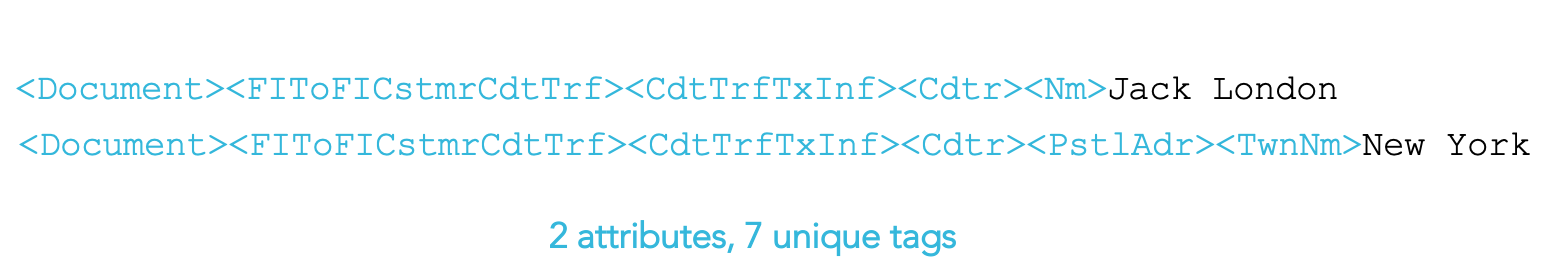

Tags can be combined into an attribute to provide a comprehensive description of a data element within its specific context. For example, the tag Nm (Name) can be utilized to describe the name of either a Cdtr (Creditor) or Dbtr (Debtor), as illustrated in the following.

Also, a Creditor can be associated with various pieces of information, such as Nm (Name) and TwnNm (Town Name). This allows for more detailed and comprehensive data representation, enhancing clarity and understanding.

An attribute represents a unique combination of tags. It is, therefore, the count of attributes, representing the different contexts of data elements in an XML message, that matters in characterizing the richness of the information within the message.

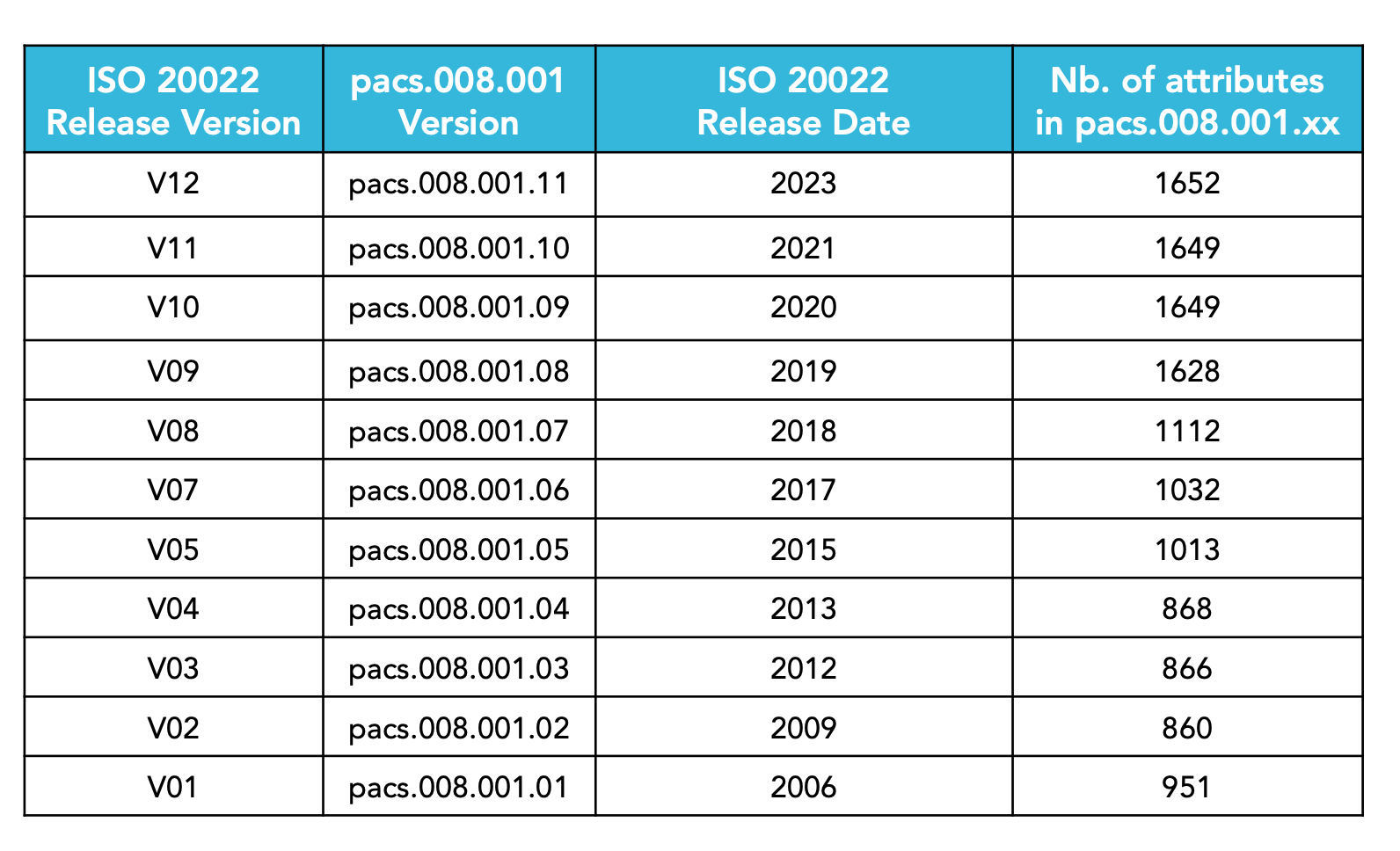

The table below displays the number of attributes for each version of the pacs.008.001 message. It’s important to note that we count all attributes without distinction, whether they are mandatory or optional in the given practice. Only through rule books or real data analysis would we uncover the current usage, including both ‘mainstream’ and ‘exotic’ attributes, and any fluctuations thereof.

Categorization

We have chosen to categorize these attributes based on the following criteria:

- Debtor ← All attributes containing the tag

Dbtr(exact or partial match) - Creditor ← All attributes containing the tag

Cdtr(exact or partial match) - Agent ← All attributes containing the tag

Agt(exact or partial match) - Remittance ← All attributes containing the tag

Rmt(exact or partial match) - Other <- All attributes not included in the above categories

This categorization is motivated by a simplistic and conceptual view, where a transaction involves the transfer of funds from one party (Debtor) to another (Creditor), facilitated by intermediaries (Agent), and encompassing details related to the purpose of the transaction and any aids in its execution (Remittance and Other).

Results

Applying the described method to all the attributes obtained for different versions of pacs.008.001, the following figure can be derived.

Hence, the number of attributes has changed from 951 in 2009 release to 1652 in 2023 release. It can seen that party data and agent data have seen increases ranging from 40% to 70% in new fields, and the most significant increase is observed in remittance information, which has grown by approximately 300% in the number of its fields. While conducting an in-depth analysis of the added data elements and impacted business domains exceeds the scope of this article, it’s crucial to understand that, at this stage, the continuous evolution of data content demands a flexible and scalable data platform to support processing and analytics efficiently, as outlined in the next step.

Next step

Capturing the new data potential offered by ISO 20022, particularly through the utilization of AI and BI, requires dedicated data management potentially tuned to your use cases. As evidenced in this article, the ISO 20022 offers an evolving landscape of data that might represent challenges for many of the current infrastructures and applications.

To address this need, we are proposing a comprehensive data platform that encompasses data processing, storage, and retrieval capabilities. Our solution leverages Swiftflow and Swiftagent to harness the rich semantics of the ISO 20022 standard, including address structuration helpers where necessary to enable powerful analytics.

We can also support you to measure the real usage of data between your bank and its counterparts, as shown in this article. For further discussions on your specific use case, please reach out directly to info@alpina-analytics.com or visit Alpina Analytics for more information.

About Us

Pierre Oberholzer is the founder of Alpina Analytics, a Switzerland-based data team dedicated to building the tools necessary to make inter-banking data, including Swift MT and ISO 20022, ready for advanced analytics.

George Serbanut is a Senior Technical Consultant at Alpina Analytics supporting Swiftagent — a conversational interface to navigate and query Swift MT and ISO 20022 data.

References

[2] https://www.iso20022.org/catalogue-messages/iso-20022-messages-archive

[3] alpina-analytics.com/products/swiftflow-2/

[4] https://www.cpg.de/en/glossary/pacs-008-iso-20022-message/

[5] https://medium.com/@domdigby/iso-20022-enhanced-data-structured-addresses-c64c645cc161